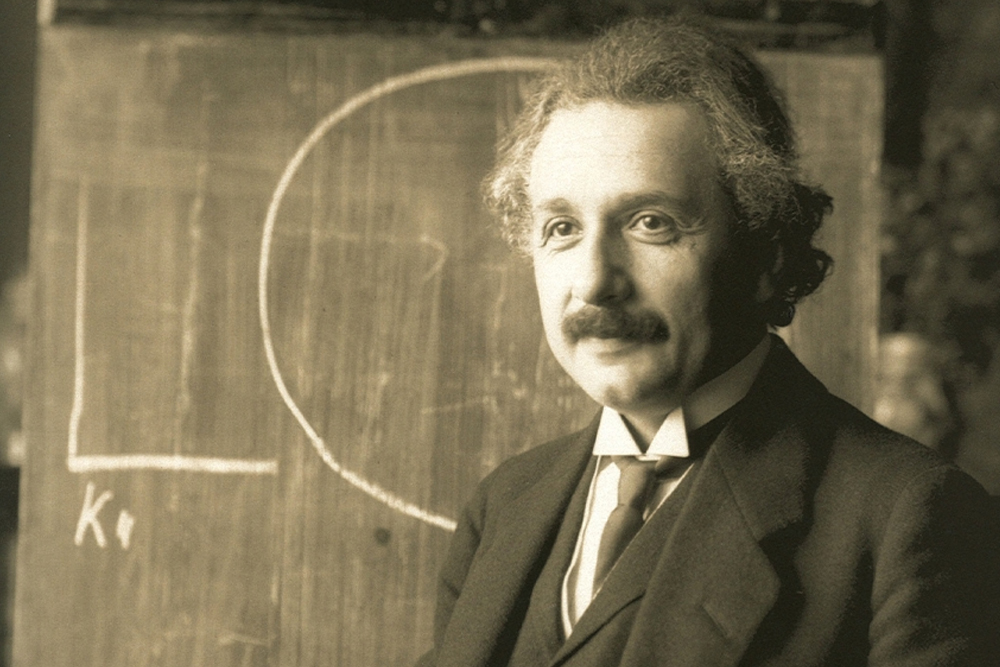

“The hardest thing to understand in the world is income tax” Albert Einstein

If Einstein found it difficult, imagine how the average South African taxpayer must feel when dealing with its tax matters? Truth be known, it’s not as difficult as Mr. Einstein made out. All you have to do is pick up the phone, call +2728 3130741 and ask to speak to one of our qualified tax advisers. This is what we do day after day. We assist clients in staying on the right side of Jan Taks whilst ensuring we optimize its tax contributions to the benefit of both parties.

The Tax Season starts 1 March, so use the rest of February to ensure all your tax affairs are in order.

1. Important note: as of October 2022 SARS may automatically register you for personal income tax should they detect economic activity on your profile from third party data submitted to them.

2. Check your tax status with SARS: From 1 December 2022 administrative penalties are charged on one or more outstanding tax returns from the 2007 tax year. SARS may collect these penalties from appointed third parties such as your employer and investment manager.

3. Update your tax details with third party service providers: ensure your accountants, investment manager and other product providers have your correct details on file, e.g. tax number and country tax residence details, email and mobile contact numbers. This will ensure your tax return and other documentation is prepopulated and ready for tax filing. From here on all relevant third-party tax certificates can be viewed on your e-filing profile.

4. Important dates on the tax calendar:

– 23 January 2023 was the deadline for provisional taxpayers to submit their tax returns. If you’ve

missed the deadline, please submit your return as soon as possible to avoid penalties.

– 28 February is the end of the 2023 tax year. The deadline to maximise the tax benefits to

encourage us to save.

– July 2023 be on the lookout for the actual date when tax reporting season opens for non-provisional taxpayers.

Tax has a significant impact on your investment returns. It is important to understand and make use of the tax advantages available to help make strategic investment choices. For queries, assistance and advice on tax related matters please don’t hesitate to contact us. Wishing you a healthy and prosperous 2023.